UPDATE: SmartTrade App is now SimplyPayMe

Life can be tough for the small trader, and new research by mobile card payment app, SmartTrade App, has revealed that one of the greatest barriers to earning a living for small businesses is the inability to – or the expense of – handling credit and debit card payments. With more than half (55%) of all small traders claiming to have lost business through a lack of card payment provision, SmartTrade App decided to delve a little deeper to find out the issues that small traders are facing.

Although arranging card payment facilities is easy enough, for a third (33%) of small traders the cost involved was sometimes prohibitive, especially now that Visa has removed the interchange cap on debit cards, meaning that certain businesses now have to pay up to 6x more per transaction – bad news for the small business.

Despite the fact that British consumers seem to be moving towards the adoption of mobile payments, with 50% of shoppers either currently using or planning to use their smartphone to make purchases, and an estimate that 20 million UK adults will have adopted this method by 2020, the debit card is still Britain’s preferred method of payment. In fact, when asked the average number of card payment requests they received for every ten customers, retailers reported as many as eight, with further statistics showing that:

- 22% of small traders said that 5 out 10 customers pay by card

- 17% of retailers said that 7 out 10 customers preferred to pay by card

- 17% of retailers said that 8 out 10 customers request card payment

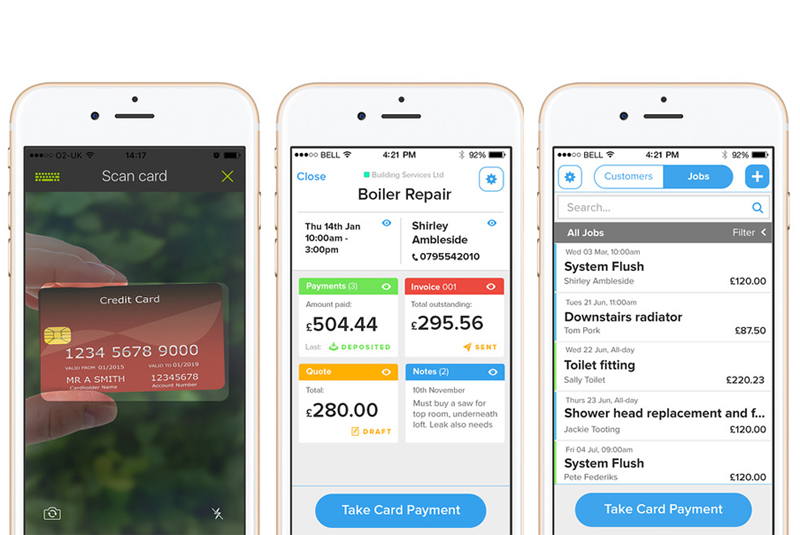

Requiring no special equipment other than a smartphone, the SmartTrade App allows installers to conduct credit and debit card sales effortlessly. Unlike traditional card readers and mobile payment providers, SmartTrade App offers a 0% transaction fee feature, where small businesses can pass or split the cost of the card fee with the customer to get rock bottom rates. It also makes life easier by tracking invoices without the use of paper, which can be simply integrated with bookkeeping programmes.

The company’s Chief Executive, Keld van Schreven, commented: ‘We conduct regular customer satisfaction surveys at SmartTrade and we’re thrilled to find that 89% of our users have found the app a useful tool for managing cashflow, while a further 83% said that it was much easier for them to collect payments using the SmartTrade App than with other providers, or simply handling cash.

‘We launched the app feeling that there must be a better way for small businesses to trade. Most card payment providers are aimed at big companies with multiple sites, where transactions fees are easily absorbed. For small businesses literally every penny counts, and we can help to make sure that they really do.’