As the year draws to a close, it might be an idea to start preparing for the new business challenges 2024 will bring. James Chillman, UK Country Manager for Fergus explains how.

From managing tax deadlines to communicating with clients and getting invoices paid on time, there is a lot of work to do for heating and plumbing businesses. It is not easy – whether you are a start-up, sole trader, or even a more established, larger contractor with multiple vans on the road.

However, there are some tasks you can start on right now, giving you more of a chance to relax and feel like 2024 will be a great year for your business. Here are five hints and tips to help plumbing and heating installers prepare for Christmas and the New Year as small businesses.

Mark key Tax Dates on your calendar

One of the first steps to financial preparedness is marking important tax dates on your calendar. For small business owners, it’s essential to be aware of deadlines for filing taxes, VAT returns, and other financial obligations.

HMRC often has specific deadlines, so staying organized and meeting these dates will prevent last-minute panic and potential penalties. Utilise online tools or accounting software to set reminders for upcoming tax deadlines, ensuring you don’t miss any critical dates.

Notify clients of closing times

Christmas and the New Year are times for everyone to take a break and spend quality time with loved ones. As a small business, it’s crucial to communicate your closing times to clients well in advance.

Send out personalised emails or make phone calls to inform them of your holiday schedule. This will help manage their expectations and reduce any last-minute demands. Transparent communication fosters good client relationships and ensures they are aware of when they can expect your services to resume in the New Year.

Invoice on time

Late payments can significantly impact a small business’s cash flow, especially during the holiday season when expenses might be higher. Ensure you send out invoices promptly and accurately. Don’t delay in following up on any overdue payments to maintain a healthy financial position for your business. Additionally, offer flexible payment options to make it easier for clients to settle their bills during this busy period.

Address the admin struggle

As a small business owner, managing administrative tasks alongside your day-to-day work can be challenging. It’s crucial to find efficient solutions to handle paperwork and invoicing. This is where Fergus Essentials comes in.

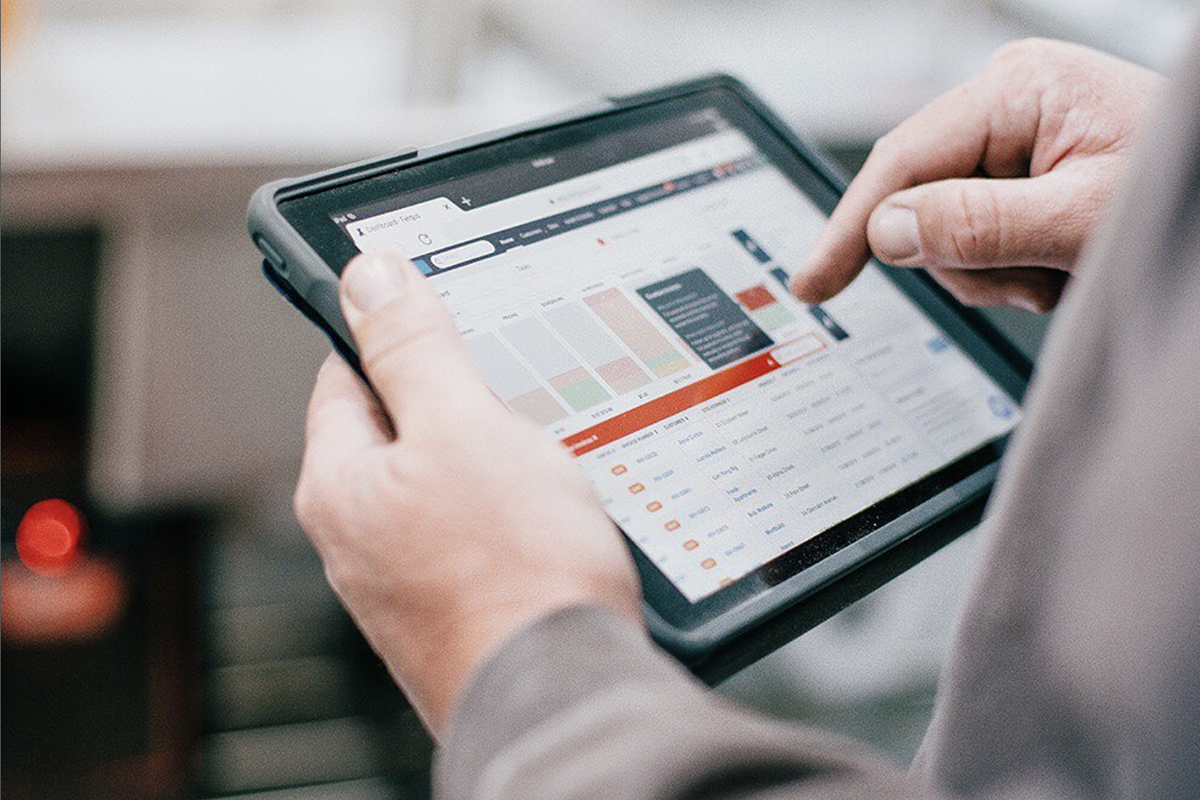

Fergus Essentials is cost-effective software designed specifically for sole traders or small teams in the trades industry. With its user-friendly interface and comprehensive features like job tracking, quoting, invoicing, and more, Fergus Essentials streamlines your administrative tasks and saves you valuable time. By using this tool, you can focus on spending time with your family and friends during the festive season.

Priced from just £19 per user per month, it offers a range of features that help streamline your day-to-day operations: whether you need to track jobs, create quotes and estimates, manage invoices, or keep your calendar and timesheets in order. It is accessible on both desktop and mobile, making it convenient for you to stay on top of your business while on the go.

Moreover, Fergus provides comprehensive support to ensure that you get the most out of the software. From onboarding and How-To-Use videos to Live Chat and email support, the company is committed to helping you succeed. Participate in their “Tools Down” sessions to interact with experts, ask questions, and learn how to make the most of Fergus Essentials for your business.