Tool theft is the scourge of the industry and is putting tradespeople out of business. ARMD, built to protect the livelihoods of tradespeople, is now encouraging the trades to protect themselves against the thieves.

“There is one tool theft every 23 minutes, which equates to approximately 23,000 a year – and that figure is only those that are reported,” explains Stephen Holland, ARMD’s co-founder.

“More than half of the builders in the UK have had their tools stolen and on average the daily loss of income is around £350, not including damage to vehicles and reputation. Worryingly, approximately half of all tradespeople do not have insurance to cover them if they suffer a tool loss.

“It can’t go on and that is why we developed ARMD. In just a few minutes you can insure your tools, protect your livelihood and secure peace of mind.”

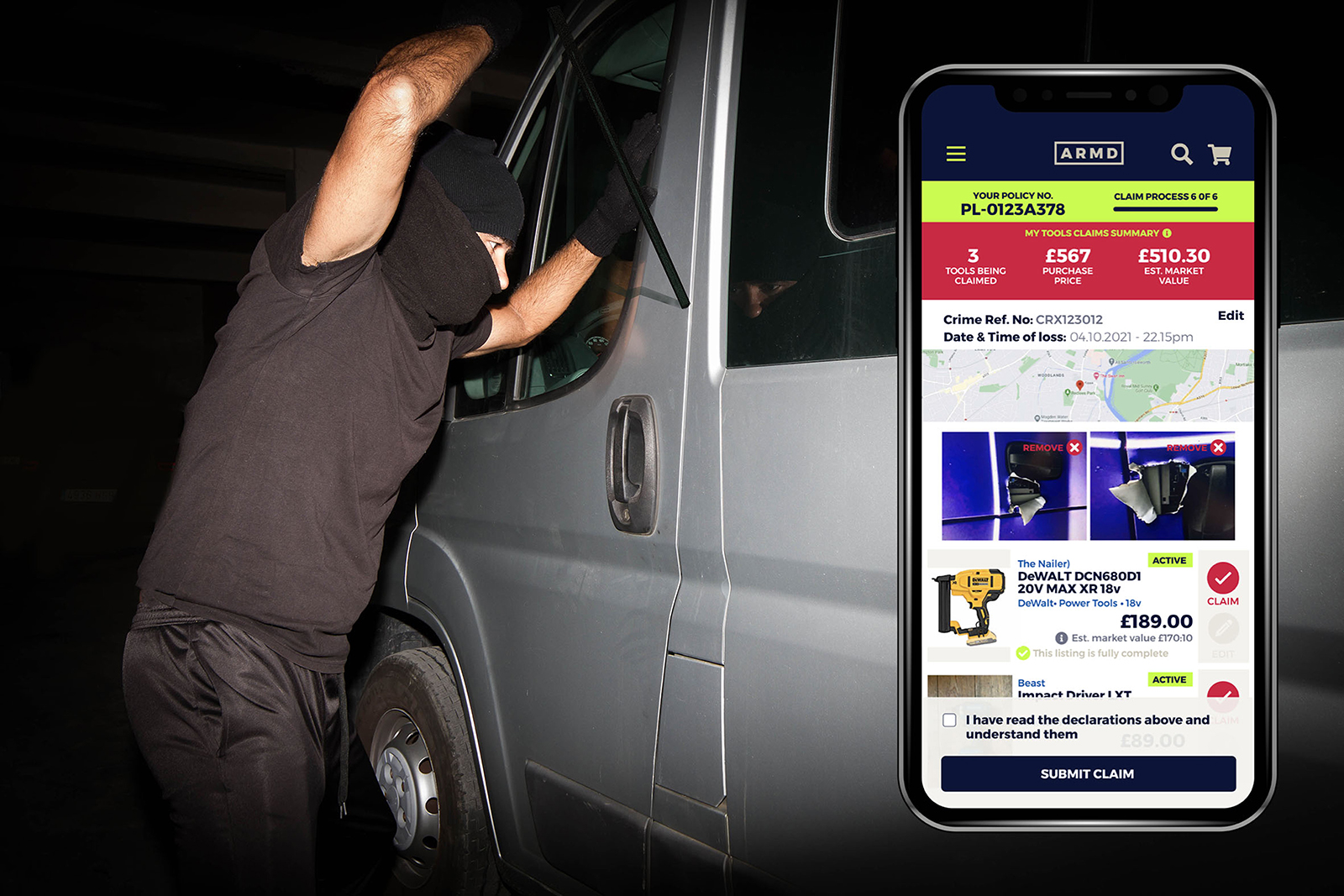

ARMD is designed to protect tradespeople so that if you do suffer a loss, it will get you back up and running as quickly as possible. ARMD lets you quickly record, protect, insure and replace your tools, either on the website or the easy-to-use App.

“We listened to and developed ARMD with the trade, to tackle the many different pain points they experience when trying to protect themselves and their tools,” continues Stephen. “We are proud that our products keep the trade working – they’re the back bone of our country and no one should be left out of work because of tool theft.”

The ARMD platform gives the trades four ways to protect their business. Firstly, a free Tool Inventory lets you easily record your tools in one place. This is useful for audits, accounting and claiming insurance.

A second, crucial, protection is fit for purpose tool insurance. If you suffer a loss, ARMD is there to help you get sorted and back to business quickly. The policy is dedicated to tool insurance, so you do not have to take your tools out of your van at night, which other policies may require you to do. Plus, you can claim digitally once your tools are in the inventory, saving hassle and time.

ARMD also gives you access to smart anti-theft security products for your van, protecting your tools with a range of powerful locks, alarms and even smart sensors that automatically call you when someone tries to break in.

Finally, there is the ARMD tool shop. Here you can choose from over 30,000 tools from the world’s leading brands and at checkout you can quickly and easily insure your tools so you are protected from the outset. Tools bought or replaced through the tool shop are automatically added to your tool inventory so that you do not need to manually upload them.

“Put together, ARMD completes the loop – record, protect, insure and replace, providing tradespeople with a practical way to prevent and recover from tool theft,” says Stephen. “Our first claim was approved in just under 72 hours, keeping a livelihood intact and the hassle to a minimum. That’s the difference ARMD can make.”

Download the ARMD App from Apple App Store or Play Store, or visit www.armd.uk

ARMD helps tradesperson get back on the tools just 72 hours after theft

ARMD revealed how it recently helped to negate the potentially devastating effect of a tool theft for Andy Jordan, turning his claim around in just 72 hours.

Andy, who works mainly for the Dante Group, has been in the trade for 13 years and had never been robbed before. He wanted, however, to get tool insurance as he sees tradespeople and their tools as “sitting ducks”. Then thieves struck and broke into his van, taking his tools.

“Luckily, I had chosen ARMD’s tool insurance which was half the price of my previous insurance, which was great. I then had my first ever claim; I don’t think any other insurance company would pay this quick. I recommended ARMD to the lads at work who could not believe how fast it was paid,” explains Andy.

The fast payment allowed Andy to get back on the tools in double quick time, reducing losses and saving his business. There is one tool theft every 23 minutes – and that’s only those that are reported. Settlement of these claims can take weeks or sometimes months, but ARMD has been developed to cut this down to just days, if not hours.

Andy used the ARMD App to get organised in the first place, as he had logged his tools in the free tool inventory. Having tools and receipts in one place enabled him to submit a fully completed claim form very soon after the crime happened. ARMD calculated the loss for the insurer, Royal Sun Alliance, and presented all the information, including proof of purchase and police crime reference number, in one easy format for claims handlers to work with. This accelerated the claims payment based on ARMD’s estimate from several weeks to a few days.

“We feel really proud to have helped Andy get back to work so quickly,” explains Stephen Holland. “Andy’s friends didn’t believe him when he told them how good we were, so he had to actually show them the payout to prove it! That is the highest compliment you can have when building a brand from the ground up.”